I. A New Engine for a Multi-Billion Dollar Market

The global piezoelectric actuator market is projected to exceed $5 billion by 2025 (CAGR 8.2%), with piezoelectric switching valves emerging as a core driver in medical devices, industrial automation, and

precision instrumentation!

1.1 Data Breakdown: Replacement vs. New Demand

Replacement (~40%): Primarily from traditional sectors like industrial automation and automotive fuel injection.

New Demand (>60%): Emerging applications in medical devices (35%), semiconductors (20%), and consumer electronics (5%) (Source: Grand View Research).

1.2 Future Trends

Short-term: Replacing solenoid valves remains the key growth driver (large existing market).

Long-term: Cross-disciplinary integration (flexible electronics, biochips) will dominate new demand surges. Piezoelectric valves may become the foundational module for "ubiquitous precision control".

II. Piezoelectric Valves VS Traditional Solenoid Valves: A Generational Leap

✅ Faster Response (μs-level actuation)

✅ Reduced Energy Consumption (no holding current loss)

✅ Extended Lifespan (no mechanical wear)

✅ Precision Leap (nanometer-level displacement control)

Top 3 Scenarios for Piezoelectric Valve Dominance:

High-Frequency & Precision Control: e.g., microfluidic chips, insulin pumps.

Miniaturization Requirements: Can be coin-sized, ideal for wearables.

Harsh Environments: High temperature/corrosion resistance, essential for oil & gas.

III. Creating New Markets: Incremental Demand

3.1 Technology-Enabled Scenarios:

Medical Miniaturization: Nano-scale drug delivery systems, endoscopic robots rely on piezoelectric valves for size reduction.

Semiconductor Manufacturing: Processes like photoresist dispensing and vacuum chamber control now require valves due to piezoelectric breakthroughs.

3.2 Policy Drivers:

Industrial energy efficiency standards (e.g., ISO 50001). Upgraded medical device safety regulations (e.g., FDA 510k). Drive adoption of low-power, high-reliability piezoelectric solutions.

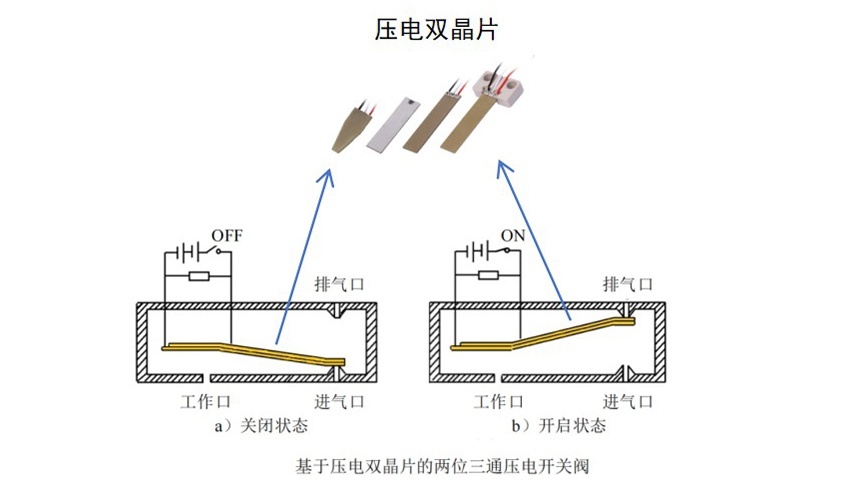

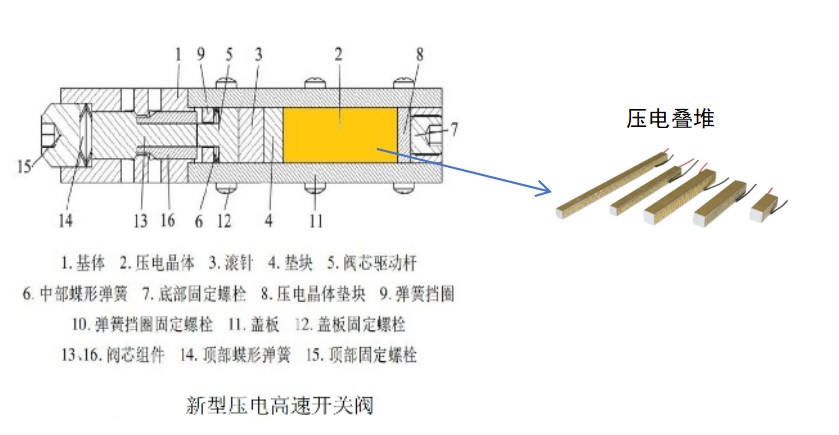

IV. Bimorph VS Ceramic Stack: Precision Selection Guide

|

Scenario |

Preferred Solution |

Key Parameter Weighting |

|

Industrial Pulse Valves (e.g., dispensing) |

Piezo Ceramic Stack |

Response Speed (<50μs) + Thrust (>500N) |

|

Consumer Electronics (e.g., AR glasses liquid cooling) |

Piezo Bimorph |

Thickness (<0.5mm) + Power Consumption (<1mW) |

|

Automotive Direct Fuel Injection |

Piezo Ceramic Stack(High-Temp) |

Operating Temp (-40~150°C) + Lifespan (10^9 cycles) |

Core Parameter Comparison

|

Parameter |

Piezo Ceramic Stack |

Piezo Bimorph |

Priority for Switching Valves |

|

Displacement |

Micrometer(10-100μm) |

Millimeter (0.1-1mm) |

Bimorph>Stack (Large bending needed) |

|

Driving Force |

High(Hundreds of Newtons) |

Low (mN to N range) |

Stack>Bimorph (High-pressure) |

|

Response Speed |

μs-level(Limited by voltage slew rate) |

ms-level (Depends on resonance) |

Stack>Bimorph (High-frequency switching) |

|

Drive Voltage |

High (200-1000V) |

Low (5-100V) |

Bimorph > Stack (Low-voltage systems) |

|

Lifespan (Cycles) |

10^8-10^9 (Layer bonding reliability) |

10^7-10^8 (Fatigue fracture risk) |

Stack>Bimorph (Long-term stability) |

|

Size/Weight |

Larger (Multi-layer stack) |

Ultra-thin & Lightweight (<1mm) |

Bimorph>Stack (Miniaturization) |

Selection Logic:

▸ Prioritize Miniaturization/Low Cost ➜ Piezo Bimorph Solution

▸Require High Force/High Pressure Tolerance ➜ Piezo Ceramic Stack Solution

V. Why choose YiNGAUN?

Piezoelectric Department of YiNGUAN focuses on the research, development, manufacturing and sales of precision positioning actuators and motion systems; which also is one of the few domestic high-tech enterprises that

owns a complete product chain from piezoelectric ceramic materials to piezoelectric ceramic motors to Nano precision piezo-motion stages. The company has rich experiences in industrialization.

Our company has four domestic service centers in Shanghai, Suzhou, Guangzhou and Chengdu, which can quickly respond to the needs of customers across the country for technical upgrades, project development

and maintenance, etc.